Metacognitive Integrity and Financial Herding

Investors have given up their sacred role in our culture. The result is a precipitous drop in alpha and an ever-rising left-tail fragility.

Seen and the Unseen

Investors have a profound role in our culture: the calculus between the seen and the unseen. But more often than not, this role is forgotten in favor of copying the seen alone and ignoring the possibility of the unseen. The breakdown of this sacred process creates great risks which can damage the course of entire careers and nations in an afternoon.

What anchors an investor’s fidelity to both poles of this calculus is instinctive. The instinct for integration, organization and reconciliation of many different rings of concern around his life, and maximizing the good among those layers, is what generates a sense of meaningfulness in his existence. Aligning his individual concerns, family, company, neighborhood, city, county and state, the state of his principles and religion, etc., and doing so across all layers of time, is experienced as meaningful. A reconciliation of the seen, determinate world of emotion, identity and motivation with the unseen, indeterminate world of anomaly and ignored complexity, is meaningful.

This instinct allows investors to reconcile complex, indeterminate and hard-to-measure, highly-ordered concerns with simplicity, and at the same time prevent inflexibility and dangerous stasis. The process of meaningful acts is “metacognitive.” This Metacognitive Integrity (“MCI”) seeks to unify the determinate and indeterminate spheres of life.

However, when an investor’s work loses contact with the meaningful, they most often fail in their sacred duty to integrate the unseen, a-priori, and indeterminant world of concerns. Their choices singularly align around mimicry of the seen choices of others. The result is herding behavior which grows into a monoculture of risk management ideologies where all investors’ results somehow fail in the same way at the same moment.

Herding Investors Participate in and Create Systemic Risk

Investor herding can be described as failures to hedge left tail events and a failure to invest in right tail opportunity. Herding is driven by the belief that an investor’s risk falls the more he conforms his choices to the average choices of other investors. It is an implicit bet that the individual would perform worse than the average if he did not mimic others (yet also bypass the conclusion he should likely not play at all).

Right and Left Tail Investments are Meaningful

The capitalist instinct and MCI are one in the same. It is a sense of transcendent meaning which impels individuals to create, earn, achieve, develop, build, save, accept risk and create convex financial exposure.

There is a feature of exposing ourselves to risk which activates our keenness and turns on previously dormant vigilance. In finance, herding is the antithesis of this. Herding lulls us into believing risk has been destroyed, and consequently as investors we shrink. If all one must do is buy stocks, buy real estate, buy China, buy anything pro-inflation, pro-globalization, buy low volatility, pro-bailout, our vigilance is cemented over as irrelevant to investment returns. The vigilant, skeptical act of paying today for a advantage to come is an affirmation that our vigilance, not our inflationist rent seeking, is the source of returns.

All Profit is Surprise

MCI is rooted in the willingness to counterbalance two “anti-mimetic” forces rather than lie in the crib of market beta: a) left tail hedging for which traders consistently pay a premium, and b) an increase of one’s risk exposure into de-novo or disruptive opportunity. It is the willingness to live at the shadow-line between market chaos and market order which preserves the integrity of an investment process so it will endure tomorrow. The endurance of a process drives investment compounding.

Predictable markets are competitive and are zero-profit. Profits arise only from surprise and deviation away from the status quo. They emerge on the frontier of chaos and order. Conversely, bets on the inertia of the status quo are attempts to bypass the requirement that only allocations on this frontier have a chance of generating profits.

Favoring allocations deep within the domain of order and “predictability” alone is speculation that others will continue creating momentum in an asset. As rivalry for these assets increases, new incremental investment is only initiated through a suspension of MCI. The suspension of a metacognitive, a-priori process is anti-capitalist. It is disengaged from the concerns driving profit making and is also grounded in a belief that the future will be drastically worse than the present.

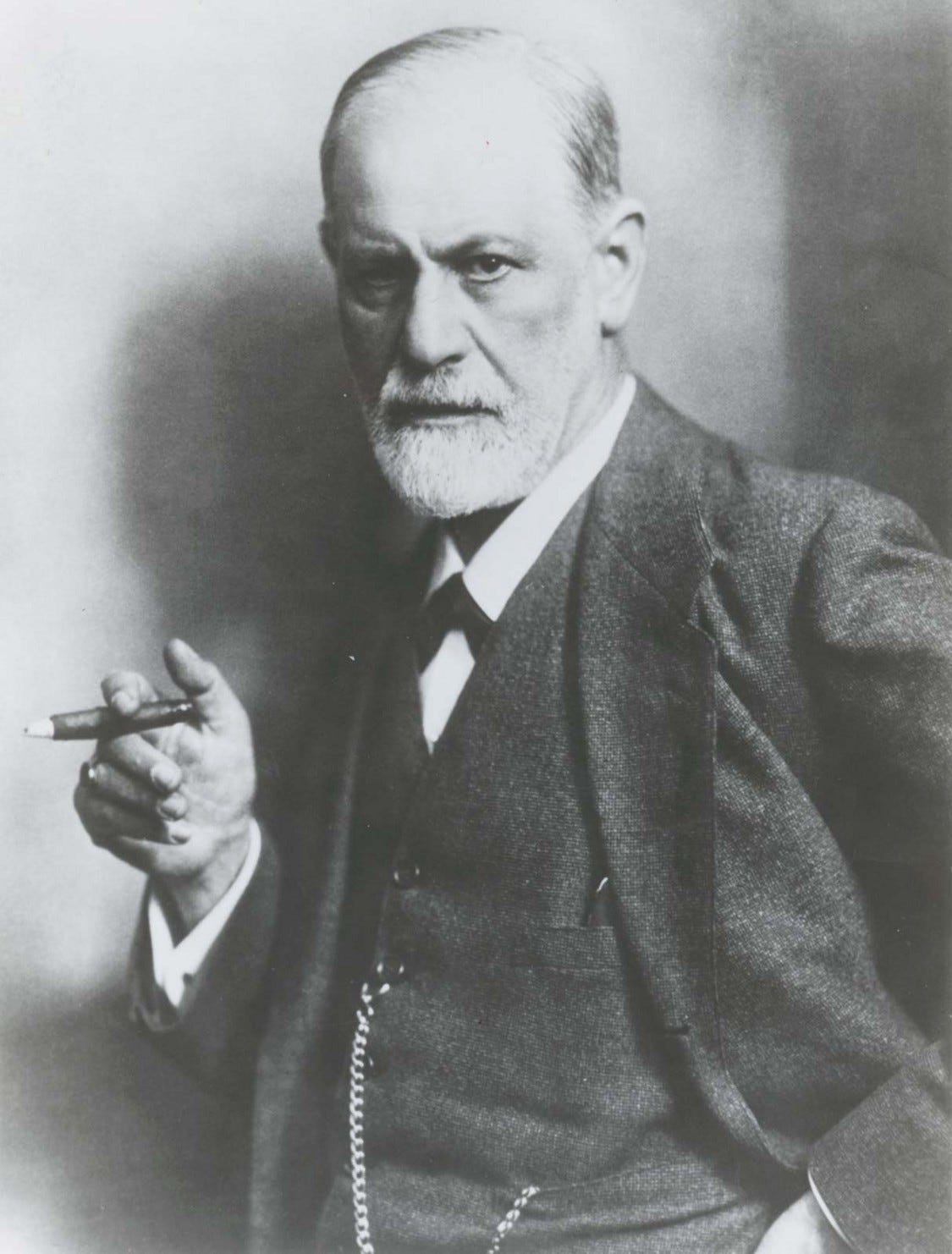

Financial Oedipus Complex

There is a foundational, axiomatic flaw from which financial herders suffer: the belief that observed past probabilities apply to future processes. The psychological impulse: “I see A is doing thus-and-so therefore it is safe to do thus-and-so,” elevates the measurability feature of a market phenomena to extreme overvaluation. Because there is something to measure, there is something to mimic. And because mimicry is valued more highly than wealth, financial herders exchange wealth creation for the opportunities to mimic. The ability to mimic is held up as “proof” or “assurance.”

Yet equating a thing’s observable average with its expected value is a pernicious error. Momentum-based speculation is driven by a belief that the previous investment experience of others will be the same for us. The want of a thing predicated only on others’ demonstration that it is want-able. And by doing so, the newcomer is a rival claimant against the first “wanters.” Other traders become our psychological progenitors and we desire their wives.

Market momentum lulls investors to believe they don’t pay for returns with risk-taking — that no copayment is required. This kind of hedonic numbing conceals that the risk/return ratio diminishes for every additional newcomer. The addition of new momentum speculators does not contribute to the value created by an original producer or investor. Sources of demand for the assets compound but the supply of value creation stays fixed. Thus, there is an increasing imbalance. The world experiences this as a “desperate search for yield.”

Monoculture = Mimicry + Scapegoats

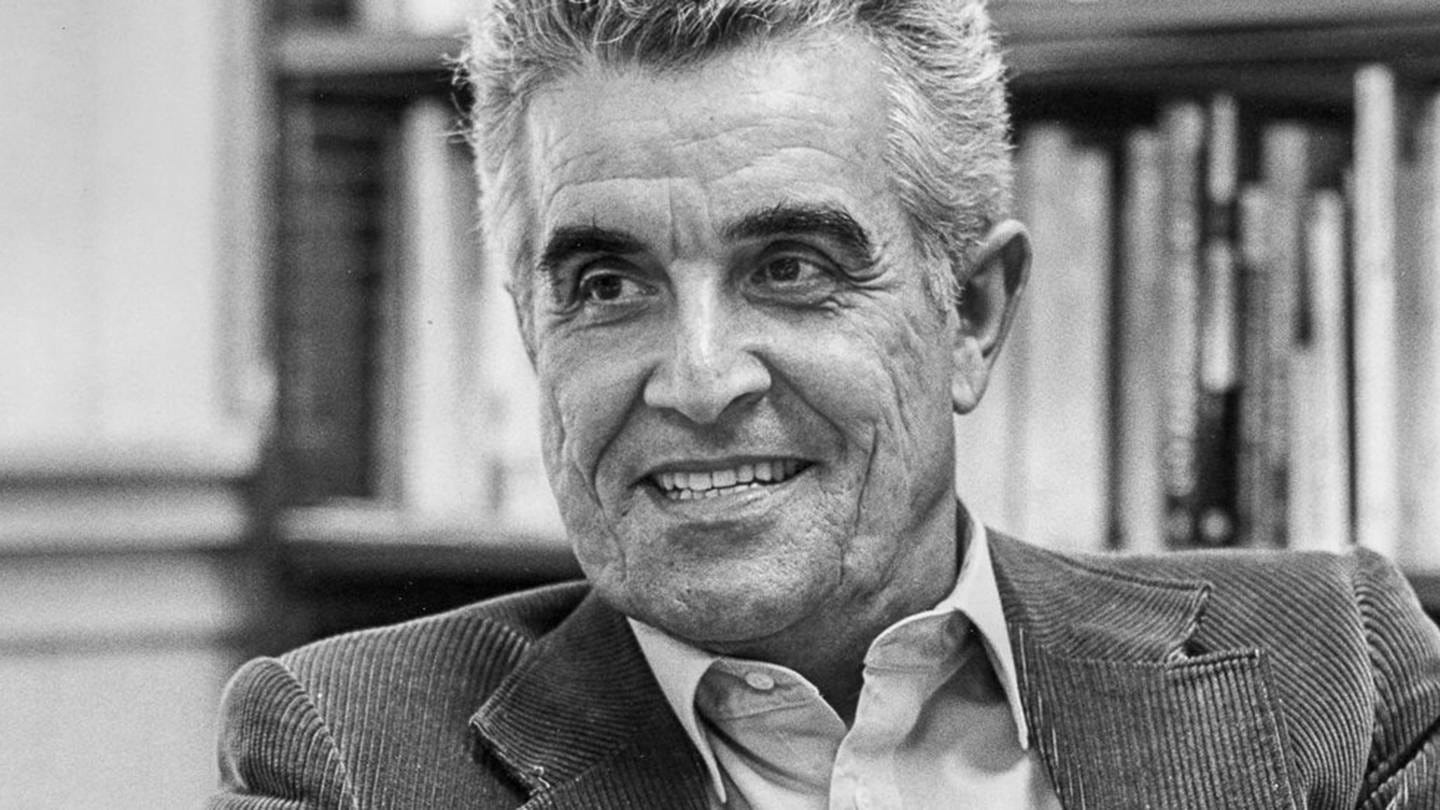

Mimicry-driven compounding of demand without equal increases in supply is known as “Mimetic Rivalry.” The first precondition for our current financial/investment monoculture is that mimetic rivalries have metastasized. These rivalries eventually create paroxysms — sudden, violent convulsions and conflicts.

Continuous debt expansion to consume and to momentum speculate occurs to paper over the growing gap between the compounded demand and the stagnant supply. An entire culture dependent on central bank bail-outs develops. Those structures which facilitate financial herding are generally those large enough to benefit from central bank intervention. If investability is first determined by which assets will be bailed out, then no original generation of profits need necessarily occur! This further hollows the productive capacity of a market and meanwhile, investment mimesis creates the very yield suppression imitators attempt to solve with their momentum speculation. And still, the notion persists that increases in price are increases in wealth.

This bail-out dependent culture maintains at its core that paying today for a positional advantage tomorrow is irrational and that tradeoffs themselves are a medieval relic. Yet an ideology which renounces the necessity of tradeoffs undermines the organization and integration of the myriad competing concerns across time for which their very instincts for meaning are built.

Investment mimesis is a defacto renunciation of one’s ability integrate individuated meaning into choices. By eroding the role individuated meaning plays in a system, the system either moves more quickly to paroxysm, that paroxysm is more violent, or both.

A Monoculture Which Lacks the Mechanics for the Discovery of Individuated Meaning Collapses

The second precondition for monoculture is the existence of scapegoats. Philosopher Rene Girard observes that when a system reaches paroxysm, a sacrifice must be made. Previous rivals ally themselves against a scapegoat. Both sides of the aisle agree: any problem can be solved with enough communal power behind it. Today, this scapegoat is the element of society which must fund the ongoing bailouts of the mimetic system: savers, entrepreneurs, those with few financial assets, those who cannot yet vote against bailouts, and those not connected to the state/central banking apparatus.

In our market environment, central banking provides a subsidy to momentum traders which have developed an ever-more leveraged monoculture around mimetic allocations. Momentum trades are short convexity, borrowing as heavily from the future as possible to maximize rent today. The insecurity tax these short-convexity traders would otherwise pay is the risk of violent paroxysm. The scapegoating of the bailouts is meant to absolve the short-convexity traders of these consequences.

While investors stung by the “coronavirus selloff” are paying the price for ignoring the risk of a predictable event, they are no less culpable of indulging in investment mimesis, of abrogating their MCI, of deposing our future for their consumption, and they are still the accomplices to sacrificial scapegoating.

Why has an entire generation been lulled into believing that owning claims against a general rent is a substitute for the investments which generate original productivity? Why has such a generation cherished mimicry so much it must existentially rely on scapegoating? Can the next generation renounce mimicry and monoculture and embrace its own innate Metacognitive Integrity? Can this generation bring themselves to gain left and right tail investment exposures as a matter of course?

In the post-CCP-Wuhan virus world, remote learning and remote working will likely go from a small feature of life to something which dominates many people’s lives. In order to thrive and be an investor in this kind of atomized world, independent sources of meaning and strong MCI are more vital than ever. Adaptiveness and polyculture are the only way we thrive.

It is a tall order, but we have no choice.

-RC

Ross Calvin is a technology entrepreneur, global macro investor, bespoke hospitality developer and executive director of the American Colossus Foundation

Please visit www.rosscalvin.com to learn more.